Council House Waiting List in Doncaster Drops by 47.8% in last 10 years

Should you buy or rent a house? Buying your own home can be expensive but could save you money over the years. Renting a property

Should you buy or rent a house? Buying your own home can be expensive but could save you money over the years. Renting a property

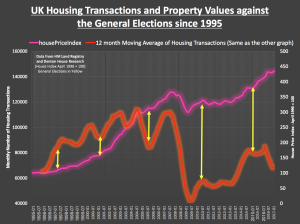

Doncaster First Time Buyers Mortgages taking 23% of their Wages I received a very interesting letter the other day from a Doncaster resident. He declared

“How far do Doncaster people go to move to a new house?” This was an intriguing question asked by one of my clients the other

There are 23.36 million properties in England and Wales with 64% being owner occupied and 36% being rented either from a private landlord, local authority

In Doncaster, of the 46,238 households, 13,515 homes are owned without a mortgage and 15,251 homes are owned by a mortgage. Many homeowners have made

Should you buy or rent a house? Buying your own home can be expensive but could save you money over the years. Renting a property

Doncaster First Time Buyers Mortgages taking 23% of their Wages I received a very interesting letter the other day from a Doncaster resident. He declared

“How far do Doncaster people go to move to a new house?” This was an intriguing question asked by one of my clients the other

There are 23.36 million properties in England and Wales with 64% being owner occupied and 36% being rented either from a private landlord, local authority

In Doncaster, of the 46,238 households, 13,515 homes are owned without a mortgage and 15,251 homes are owned by a mortgage. Many homeowners have made

We offer instant online valuations, just enter you post

code below for an indication of what your property is worth.

You can also get a lettings valuation to see what rental you can

achieve for your rental property.

This blog follows the property market in Doncaster and the surrounding areas. From potential buy to let property deals, to analysis and comments on the local property market. If you’re serious about investing in buy to let property in Doncaster, then you’ll find all the information you need here.

Copyright © 2024 Doncaster Property Blog | All Right Reserved